Cold War Economies & 2-Speed Effects

Thesis

The United States is locked into a cold war over AI with China. This the single most important game being played over the next few years. Consequences are on the level of the nuclear arms race in the mid-20th century. Whoever dominates AI shapes not only military power but also the foundations of economic control. It’s important to highlight this in order to understand that Inflation risks and consumer discontent is an afterthought in this environment.

In order to achieve its objective, the government is committed to spending at scale, routing money into fabs, data centres, natural resource mining and chips supply chains.

Here is where it gets interesting, since the largest indices are heavily weighted toward the firms capturing this spending, stock benchmarks climb even as the rest of the economy softens. Households bear the cost through persistent inflation and weaker job prospects.

Now even if that pressure spills into visible unrest, Trump’s default response will be to push cash directly to households in the form of stimulus or relief programs, and this is where crypto benefits the most.

Mechanics

Deficits are sustained and concentrated. Subsidies, tax credits, and procurement orders guarantee flows to a small cluster of firms tied into AI and strategic industry. We are talking about hundreds of billions routed into sectors that employ relatively few. NVIDIA alone is close to 9% of the S&P’s market value, yet the company has fewer than 40,000 U.S. workers. This means that massive fiscal flows are captured by firms whose labour footprint is tiny.

Indices respond directly to these flows. because benchmarks like the Nasdaq are dominated by these same companies. Revenues jump, multiples expand and passive flows reinforce a move higher.

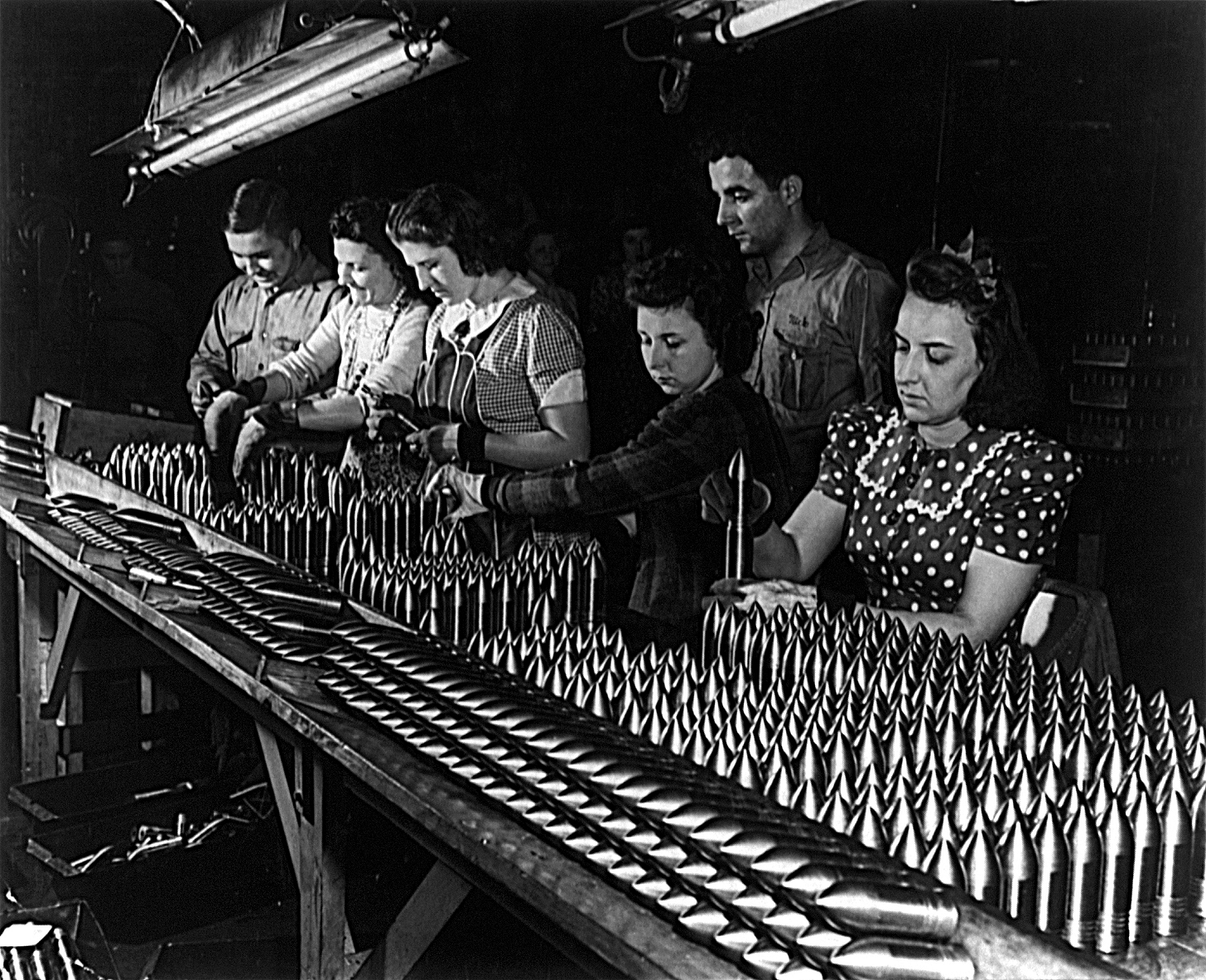

Labour intensive industries, by contrast, stagnate. Wage growth is inconsistent, services demand is cooling, and prices remain sticky. the inflationary pressure comes from both global supply frictions (tariffs) and the demand created by concentrated fiscal spending. So the fiscal channel that once, in WWII or the Cold War industrial build-outs, absorbed millions of workers, now bypasses most of the labour market.

Trump Playbook

Historically when households strain under inflation and weak job growth, the government has a set of familiar responses. One option is direct transfers, such as rebates, tax credits, or forgiveness programs. Another is rate policy (the fed leaning higher to contain inflation even as it risks growth).

So far, the current response has been the opposite: rate cuts without major household offsets, which loosens conditions for indices while leaving consumers high and dry.

if public discontent grows in the form of social breakdowns, it is more likely that Trump resorts to quick stimulus to buy social peace rather than reorienting the spending. These can come in the form of tariff revenue distribution, stimulus checks and forgiveness programs. Such measures patch the household side temporarily without changing the underlying bias of the state toward strategic industry.

BTC & Crypto

BTC is now in the winners camp alongside AI. Its no mistake that David Sack’s is the czar of AI and crypto (this in itself is a signal).

Many high level Trump admin officials hold crypto themselves. That increases alignment between policy and personal exposure. At the same time, the government is signalling BTC as an institutional asset. that means fiscal and policy flows will increasingly reward BTC holders.

This also strengthens the inflation hedge narrative. If the state itself is promoting the purchasing/hoarding of BTC while running large deficits and accepting higher inflation as the cost of primacy, then private actors feel validated piling in alongside it. When stimulus checks or rebates are pushed out to households to contain unrest, a substantial share of that cash reflexively finds its way into crypto.

And what we’re seeing now validates the above. BTC is fully syncing with the macro cycle. A slow melt-up in both stocks and crypto, punctuated by mini blowoffs and retraces. This is stage prep for a broader bubble.

Conclusion

And that’s the game. Cold war economies are 2-speed by design. The winners subsidized and strategic, the others lagging. The state tolerates inflation or repression as the cost of sustaining primacy.

Eventually, the pressure builds. Sometimes it is inflation itself that breaks markets. Sometimes political backlash hits the winners directly.

The mid-term elections are an important inflection point on this second risk. If households don’t get tangible relief before then, expect populist blowback. A potential democratic win at the mid-terms means increased risk premia which could pop the bubble.